Plooto

Check out this in-depth Plooto review to learn more about its core features, key specifications, integrations, and pricing plans.

What is Plooto?

Plooto is a payment automation platform that allows growing businesses to streamline their cash management. It offers a wide range of finance tools particularly for small to medium-sized businesses that enable you to have complete control over your financial activities.

The ultimate objective of Plooto software is to provide the right tools to optimize financial management. In addition, the vendor’s vision is to create a well-rounded financial operations platform that unties the knots within complex workflows by unifying reporting, reconciliations, processes, and payments.

One of the main reasons why Plooto is one of the most popular financial tools is that you can process payments even if your customers or clients do not have a Plooto account.

In a nutshell, it is a well-developed financial reporting platform that provides you with all the tools you need to improve financial reporting and management.

Vendor Details

- Company: Plooto Inc.

- Website: https://www.plooto.com/

- Founded in 2015

- Country of origin: Canada

Plooto Key Features

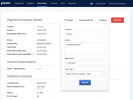

When you look for Plooto payment processing on the web, you will find a list of features that make it one of the most reliable payments and financial reporting tools.

-

Accounts payable

The platform streamlines and automates your accounts payable and thereby enables you to boost productivity and overall efficiency.

Users can define custom rules to automate, direct, and personalize payment approvals to the right team member. In addition, this feature also reduces your dependence on paperwork and eliminates the headaches associated with lost invoices and other manual AP tasks.

You can schedule your payments to improve the management of your cash flow and also leverage the benefits of early-payments discounts.

It takes just two clicks for a user to add suppliers, vendors, and billers from the Plooto Network.

-

Accounts receivable

The account receivable feature offers everything you need to get paid faster. It automates the predictable and recurring accounts receivable tasks, which allows you to save time.

Automated accounts receivable enables you to import invoices automatically and save considerable time due to the powerful set of recurring payments and Pre-Authorized Debit (PAD) features.

This feature also ensures that you can streamline your cash flow, stay updated when customers pay, and also track invoices. The tool provides a clear view of all the pending, completed, and new receivables on a single screen.

-

International payments

The international payments feature makes sure that your international financial transactions are in safe hands. You can use the platform to transfer money within Canada, the U.S., and more than 30 countries worldwide.

In addition, you can also get rid of expensive wire fees and carry out cross-border payments through a flat fee of $9.99.

-

CRA payments

This feature simplifies remittances made to the Canadian Revenue Agency (CRA). Users can make CRA payments from any location, at any time, and avoid the long queues in the banks.

Plooto Features Overview

- Approval process control

- Billing & invoice

- Cash management

- Collections management

- Contact database

- Contingency billing

- Document management

- Fraud detection

- Invoice processing

- Multi-currency

- Online invoicing

- Online payments

- Payment processing

- Vendor management

- International payments

- Recurring payments

- Automated workflows

- Recurring invoices

Plooto Pricing

Price: $25 per month and includes 10 free domestic payments each month.

Plooto Pros and Cons

- Pre-authorized debit and credit receivables can be done in U.S. and Candadian dollars

- The platform makes it very easy to carry out international transactions across the globe

- Some users have said that the amount of time it takes for the cash to reach the recipient’s bank account is faster than Stripe

- Integration with QuickBooks and Xero

- It is very easy to set up payments receivable

- The platform provides excellent tools which can be used to track the approval process for payments

- Rising per transaction fee

- Very poor approval tier setup

- 4-day turnaround time to complete payments

- Does not provide a default bank account option

- Cross-border receivables are very limited

- Searching for a vendor’s banking information is not very user friendly

Plooto Integrations

- QuickBooks

- QuickBooks Online

- Xero

Plooto Specifications

Free Trial – Yes

Free Version – No

Deployment

- Cloud-hosted

Devices supported

- Windows

- Linux

- Mac

- Android

- iPhone/iPad

- Web-based

Training

- In-person

- Live online

- Webinars

- Documentation

- Videos

Typical customers

- Small businesses

- Medium businesses

- Large businesses

Plooto pricing plans

- $25 per month

Languages supported

- English

Plooto support

- FAQs

- Knowledge base

- Phone support

- 24/7 (live rep)

- Chat

Plooto Alternatives

- TimeSolv

- BQE Core Suite

- Accelo

- Lockstep Collect

- Sage Intacct

- Zoho Invoice

- Odoo

- Avaza

- Marketing 360

- Tridens Monetization

- Harmony PSA

- Scoro

- Zoho Books

- Freshbooks

- Melio

- SutiAP

- Goby

If you liked reading this Plooto review, leave your comments below and tell us more about your favorite features.